Organize your

financial life

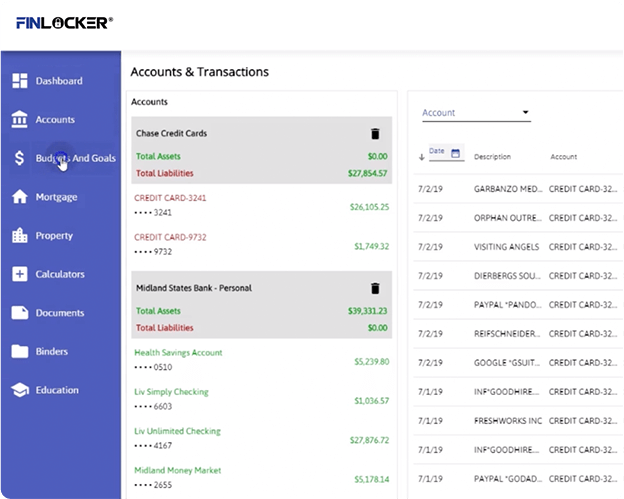

Connect your financial data in one place, from checking accounts to credit cards to auto loans and even investment accounts.

FinLocker allows you to view your credit score and report, monitor credit, and provides a “borrower readiness” assessment, letting you know when you’re likely to be approved for a mortgage.

Connect your financial data in one place, from checking accounts to credit cards to auto loans and even investment accounts.

You control what is shared and when; all data is encrypted with bank level security.

Establish goals for saving and track your progress with real-time budgets to better understand your spending.

Educational videos (over 140+) to learn more about homeownership, credit and borrowing, including mortgage terms, process and products.

Track the value of your property and recently sold homes in your area.

Your mortgage broker has partnered with FinLocker to provide this to you at no cost.

Qualify First Mortgage would like to provide you with this secure financial application to help guide your through the mortgage process and beyond.

Your FinLocker dashboard summarizes important financial information such as: account balances, transactions, net worth, budgeting, credit score and credit report, cash flow analysis, estimated home value, offers and promotions from a financial institution, all in one place.